How Computer Formula Big Ideas And The Best Of Intentions Burned Down New York: A Cautionary Tale for the 21st Century

4.4 out of 5

| Language | : | English |

| File size | : | 4740 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 338 pages |

In his new book, New York Times bestselling author Kurt Eichenwald takes us inside the world of high-frequency trading, a secretive and often unregulated industry that has the power to move markets and even crash the global economy. Eichenwald follows the rise and fall of some of the most prominent figures in high-frequency trading, including Sergey Aleynikov, a Russian immigrant who became a billionaire by exploiting a flaw in the Nasdaq stock exchange.

Eichenwald's book is a gripping narrative that reads like a thriller. He takes us inside the trading floors of the world's largest banks and hedge funds, where traders are making millions of dollars in seconds. He shows us how high-frequency trading has changed the way the stock market works, and how it has made the market more volatile and dangerous.

But Eichenwald's book is more than just a story about Wall Street. It is also a cautionary tale about the dangers of unchecked technological innovation. In the rush to embrace new technologies, we often fail to consider the potential consequences. The story of high-frequency trading is a case in point. This new technology was supposed to make the market more efficient and transparent. But it ended up ng the opposite. It made the market more opaque and complex, and it gave a handful of traders an unfair advantage.

The story of high-frequency trading is a reminder that we need to be careful about how we use technology. We need to think about the potential consequences before we embrace new technologies, and we need to be prepared to regulate them if they pose a threat to our society.

The Rise of High-Frequency Trading

High-frequency trading is a type of algorithmic trading that uses computers to execute trades at extremely high speeds. High-frequency traders use sophisticated algorithms to analyze market data and identify trading opportunities. They then use computers to execute trades in milliseconds, often before other traders have a chance to react.

High-frequency trading has become increasingly popular in recent years. In 2009, high-frequency traders accounted for about 10% of all trading volume on the New York Stock Exchange. By 2018, that number had grown to over 50%.

The rise of high-frequency trading has had a number of significant impacts on the stock market. First, it has made the market more volatile. High-frequency traders often engage in short-term trading strategies, which can lead to sharp swings in prices. Second, high-frequency trading has made the market more difficult for individual investors to navigate. Individual investors often lack the sophisticated algorithms and high-speed computers that high-frequency traders use. This can give high-frequency traders an unfair advantage.

The Fall of Sergey Aleynikov

Sergey Aleynikov was one of the most successful high-frequency traders in the world. In 2009, he made over $100 million trading stocks. But in 2010, he was arrested and charged with stealing proprietary trading code from his former employer, Goldman Sachs.

Aleynikov's arrest shook the world of high-frequency trading. It showed that even the most successful traders were not immune to the law. It also raised questions about the ethics of high-frequency trading.

Aleynikov was eventually convicted of theft and sentenced to eight years in prison. He was released in 2018 after serving five years of his sentence.

The Future of High-Frequency Trading

The future of high-frequency trading is uncertain. Regulators are taking a closer look at the industry, and there is a growing movement to ban high-frequency trading altogether.

But even if high-frequency trading is banned, it is likely that other forms of algorithmic trading will emerge. The use of computers to execute trades is becoming increasingly common, and it is likely that this trend will continue in the future.

The story of high-frequency trading is a cautionary tale about the dangers of unchecked technological innovation. We need to be careful about how we use technology, and we need to be prepared to regulate new technologies if they pose a threat to our society.

4.4 out of 5

| Language | : | English |

| File size | : | 4740 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 338 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Joe Hayes

Joe Hayes Jimbo

Jimbo Joanna Hunt

Joanna Hunt Jiri Kolaja

Jiri Kolaja Lisa Graves

Lisa Graves Kathy Arlyn Sokol

Kathy Arlyn Sokol John Lahr

John Lahr Vicki Rozema

Vicki Rozema Sister Dang Nghiem

Sister Dang Nghiem Jim Marrs

Jim Marrs Joe Harkness

Joe Harkness Victoria Murphy

Victoria Murphy John Mcphee

John Mcphee Shirley O Corriher

Shirley O Corriher Jim Mclean

Jim Mclean Katherine Routledge

Katherine Routledge John Gilstrap

John Gilstrap Yury Kronn

Yury Kronn Kyra Sundance

Kyra Sundance Kha Yang Xiong

Kha Yang Xiong

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Percy Bysshe ShelleyUnlocking Harmony: Understanding the Distinct Coping Mechanisms of Men and...

Percy Bysshe ShelleyUnlocking Harmony: Understanding the Distinct Coping Mechanisms of Men and... Ken SimmonsFollow ·3.7k

Ken SimmonsFollow ·3.7k Paulo CoelhoFollow ·17k

Paulo CoelhoFollow ·17k Caleb LongFollow ·11.2k

Caleb LongFollow ·11.2k Jett PowellFollow ·11.1k

Jett PowellFollow ·11.1k Evan HayesFollow ·11.4k

Evan HayesFollow ·11.4k Holden BellFollow ·19k

Holden BellFollow ·19k Angelo WardFollow ·4.1k

Angelo WardFollow ·4.1k Julian PowellFollow ·13.6k

Julian PowellFollow ·13.6k

Jesus Mitchell

Jesus MitchellDiscover the World of Satisfying Meals with Or...

In a world where culinary creations often...

Darius Cox

Darius CoxJourney into the Extraordinary Life of Kublai Khan: An...

Immerse Yourself in the Fascinating...

Gil Turner

Gil TurnerThe Fourth Industrial Revolution: The Precariat and the...

In his groundbreaking book, The Fourth...

Jonathan Franzen

Jonathan FranzenGenghis Khan: His Heirs and the Founding of Modern China

Genghis Khan, the...

Eugene Powell

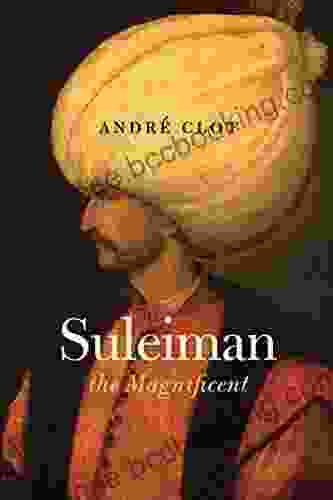

Eugene PowellJourney Through the Golden Age of the Ottoman Empire with...

Delve into the Enchanting World of the...

4.4 out of 5

| Language | : | English |

| File size | : | 4740 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 338 pages |