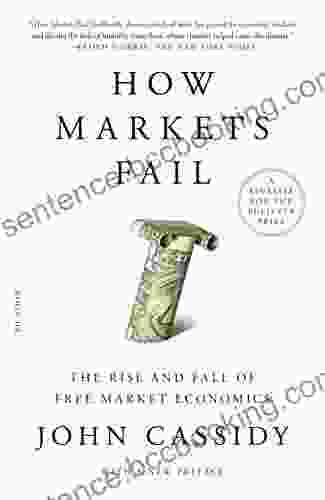

Unveiling the Logic of Economic Calamities: A Comprehensive Review of "How Markets Fail"

In the realm of economics, the concept of "market failure" holds immense significance. It refers to situations where markets, left to their own devices, fail to allocate resources efficiently or promote social welfare.

4.5 out of 5

| Language | : | English |

| File size | : | 1266 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 401 pages |

Recognizing the profound implications of market failures, renowned economist John Kay penned the seminal work, "How Markets Fail: The Logic of Economic Calamities." This thought-provoking book provides a comprehensive framework for understanding the causes and consequences of market failures, offering invaluable insights into the intricate dynamics that shape economic calamities.

Key Concepts and Case Studies

At the heart of "How Markets Fail" lies a rigorous analysis of market failures, emphasizing their diverse forms and far-reaching impact on economies and societies.

- Externalities: When economic activities affect third parties not directly involved in the transaction, leading to either positive or negative consequences. For instance, pollution from a factory negatively impacts neighboring communities.

- Public Goods: Goods with non-rivalrous (consumption by one person does not preclude consumption by others) and non-excludable (costs of exclusion are prohibitively high) characteristics, such as national defense or clean air. Market mechanisms often fail to provide optimal levels of these goods.

- Information Asymmetries: Situations where one party to a transaction possesses more or better information than the other, leading to adverse selection (when buyers or sellers can hide information) or moral hazard (when one party can act opportunistically after entering into an agreement).

- Natural Monopolies: Industries where it is more efficient for a single provider to operate, leading to a lack of competition and potential exploitation of consumers.

- Systemic Risk: When the failure of one market participant can have cascading effects, destabilizing the entire financial system, as witnessed during the 2008 financial crisis.

"How Markets Fail" meticulously examines real-world case studies to illustrate these concepts. From the subprime mortgage crisis to the collapse of Lehman Brothers, the book draws valuable lessons from past economic calamities, highlighting the role of market failures in triggering and exacerbating financial turmoil.

Implications for Economic Policies

Beyond theoretical insights, "How Markets Fail" offers pragmatic guidance for policymakers seeking to address market failures and promote economic stability.

- Regulation: Imposing rules and oversight to correct market failures, such as antitrust laws to prevent monopolies or consumer protection regulations to address information asymmetries.

- Fiscal Policy: Utilizing government spending and taxation to address externalities or provide public goods, such as investing in renewable energy to mitigate pollution or subsidizing healthcare to ensure universal access.

- Monetary Policy: Managing interest rates and money supply to address financial imbalances or prevent systemic risks, such as raising interest rates to curb inflation or providing liquidity during economic downturns.

- Institutional Design: Creating or reforming institutions to enhance market efficiency and resilience, such as independent regulatory agencies to protect consumers from market abuses or bankruptcy laws to facilitate Free Downloadly resolutions of financial distress.

- Behavioral Economics: Incorporating insights from psychology and behavioral economics to understand how cognitive biases and emotional factors can influence market outcomes, informing policy interventions to address these biases.

Building Economic Resilience

"How Markets Fail" emphasizes the importance of fostering economic resilience to minimize the likelihood and severity of future economic calamities. This involves:

- Diversity and Competition: Promoting a diverse economic landscape with multiple industries and businesses, reducing the risk of systemic failures.

- Financial Stability: Implementing prudent regulations and policies to prevent excessive risk-taking and ensure the soundness of financial institutions.

- Social Safety Nets: Establishing robust social safety nets to protect vulnerable populations during economic downturns, mitigating the social and economic costs of crises.

- Education and Awareness: Enhancing financial literacy and promoting awareness of market failures to empower individuals to make informed decisions.

- International Cooperation: Fostering international cooperation to address global economic challenges and prevent spillovers of financial crises across bFree Downloads.

"How Markets Fail: The Logic of Economic Calamities" is a groundbreaking work that profoundly enriches our understanding of market failures and their devastating consequences. By illuminating the intricate mechanisms that can lead to economic calamities, John Kay provides policymakers, economists, and the general public with invaluable insights for avoiding and mitigating future crises.

Through a comprehensive analysis of case studies and policy implications, the book serves as an indispensable guide for shaping economic policies, promoting financial stability, and fostering economic resilience. By embracing the lessons learned from past failures, we can collectively work towards creating a more robust and equitable economic system for generations to come.

Read "How Markets Fail" on Google Books

Image Alt Attributes:

- A graph depicting the relationship between market failures and economic calamities

- A group of diverse individuals discussing economic policy

- A cityscape representing economic resilience and stability

- A book cover of "How Markets Fail" by John Kay

4.5 out of 5

| Language | : | English |

| File size | : | 1266 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 401 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Jim Masterson

Jim Masterson Jung Yun

Jung Yun John Ford

John Ford Jim Ziolkowski

Jim Ziolkowski Lee Loughridge

Lee Loughridge Joel Thomas Chopp

Joel Thomas Chopp Yahtzee Croshaw

Yahtzee Croshaw John Brooks

John Brooks John Lukacs

John Lukacs Joel Greenberg

Joel Greenberg Ramon Ray

Ramon Ray John Archambault

John Archambault Joe Bonomo

Joe Bonomo Sandra Magsamen

Sandra Magsamen John Burroughs

John Burroughs Yoshiko Uchida

Yoshiko Uchida Jimmy Johnson

Jimmy Johnson John Cassidy

John Cassidy Joe Kuster

Joe Kuster Thomas J Campanella

Thomas J Campanella

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

F. Scott FitzgeraldElevate Your IELTS Writing: Discover the Ultimate Sample Essays Collection...

F. Scott FitzgeraldElevate Your IELTS Writing: Discover the Ultimate Sample Essays Collection...

Julian PowellUnlock the Secrets to Thriving Soil and Bountiful Harvests: Soil Fertility...

Julian PowellUnlock the Secrets to Thriving Soil and Bountiful Harvests: Soil Fertility... Ted SimmonsFollow ·4.3k

Ted SimmonsFollow ·4.3k Raymond ParkerFollow ·6.6k

Raymond ParkerFollow ·6.6k Devon MitchellFollow ·10.4k

Devon MitchellFollow ·10.4k Jean BlairFollow ·7.6k

Jean BlairFollow ·7.6k George OrwellFollow ·6.5k

George OrwellFollow ·6.5k Jon ReedFollow ·3.5k

Jon ReedFollow ·3.5k Victor TurnerFollow ·5.3k

Victor TurnerFollow ·5.3k W.H. AudenFollow ·18.7k

W.H. AudenFollow ·18.7k

Jesus Mitchell

Jesus MitchellDiscover the World of Satisfying Meals with Or...

In a world where culinary creations often...

Darius Cox

Darius CoxJourney into the Extraordinary Life of Kublai Khan: An...

Immerse Yourself in the Fascinating...

Gil Turner

Gil TurnerThe Fourth Industrial Revolution: The Precariat and the...

In his groundbreaking book, The Fourth...

Jonathan Franzen

Jonathan FranzenGenghis Khan: His Heirs and the Founding of Modern China

Genghis Khan, the...

Eugene Powell

Eugene PowellJourney Through the Golden Age of the Ottoman Empire with...

Delve into the Enchanting World of the...

4.5 out of 5

| Language | : | English |

| File size | : | 1266 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 401 pages |