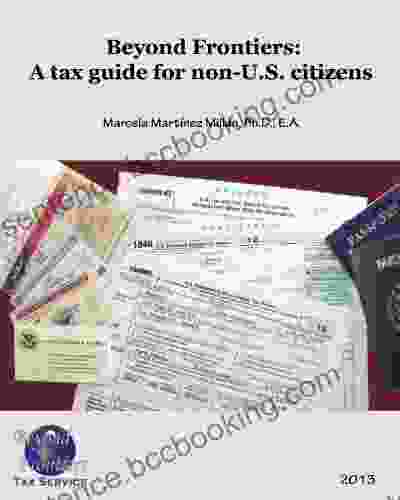

The Essential Tax Guide for Non-Citizens: Navigating U.S. Tax Laws

As a non-citizen residing in the United States, understanding the complexities of U.S. tax laws can be overwhelming. This comprehensive tax guide has been meticulously crafted to provide you with a clear and concise understanding of your tax filing requirements, helping you navigate the complexities and maximize your deductions and credits. Whether you're a green card holder, international student, or working professional on a visa, this guide will empower you with the knowledge to fulfill your tax obligations and protect your financial interests.

5 out of 5

| Language | : | English |

| File size | : | 19811 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 397 pages |

| Lending | : | Enabled |

Understanding Your Tax Residency Status

The foundation for understanding your tax responsibilities lies in determining your residency status. This status dictates the taxes you are required to pay and the forms you need to file. The guide thoroughly explains the various residency categories, including permanent residents, non-resident aliens, and dual residents, and provides specific guidance on how to determine your status based on your specific circumstances.

Filing Requirements and Deadlines

Once your residency status is established, knowing when and how to file your taxes is crucial. This guide provides a clear breakdown of filing requirements for both federal and state taxes, including specific deadlines for non-citizens. It also offers step-by-step instructions on completing the necessary tax forms and provides tips for organizing your tax documents.

Taxable Income and Deductions

Understanding what constitutes taxable income and how to optimize your deductions is key to minimizing your tax liability. This guide covers all types of income subject to taxation, including wages, salaries, and investments. It also provides a detailed analysis of allowable deductions and credits, such as the standard deduction, mortgage interest deduction, and earned income tax credit, helping you maximize your tax savings.

Tax Credits and Treaty Benefits

Taking advantage of tax credits and treaty benefits can significantly reduce your tax burden. This guide thoroughly examines various tax credits and treaties available to non-citizens and provides detailed guidance on how to qualify and claim them. By utilizing these provisions, you can further optimize your tax situation and ensure you're not paying more than necessary.

Avoiding Penalties and Audits

To ensure compliance and avoid costly penalties and audits, it's essential to be aware of potential pitfalls and common mistakes made by non-citizens. This guide provides practical advice on how to avoid penalties associated with late filing, underpayment, and incorrect reporting. It also offers valuable insights on how to prepare for audits, should you be selected.

International Considerations

For non-citizens with financial ties to other countries, understanding how international tax laws interact with U.S. tax laws is crucial. This guide provides detailed insights into the concepts of foreign tax credits and income exclusion, helping you avoid double taxation and optimize your global tax situation.

Estate Planning for Non-Citizens

Ensuring the proper transfer of your assets upon your passing is essential for non-citizens with estates in the United States. This guide explores the nuances of estate planning for non-citizens, including issues related to inheritance tax, estate tax, and trusts. By understanding these complexities, you can protect your loved ones and ensure your assets are distributed according to your wishes.

Navigating the complexities of U.S. tax laws as a non-citizen can be challenging, but it doesn't have to be overwhelming. With the insights and guidance provided in this comprehensive tax guide, you can confidently fulfill your tax obligations, maximize your tax savings, and protect your financial interests. Remember, knowledge is power, and this guide empowers you with the knowledge to take control of your tax situation and secure your financial well-being.

Free Download Your Copy Today!

To obtain your copy of the Tax Guide For Non Citizens and gain access to a wealth of invaluable tax information, follow this link: [Insert Free Download Link]

5 out of 5

| Language | : | English |

| File size | : | 19811 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 397 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Joey Chou

Joey Chou Joel Lobenthal

Joel Lobenthal John H Carroll

John H Carroll Michele Barber Jones

Michele Barber Jones John Geiger

John Geiger John Endris

John Endris John Hutchison

John Hutchison Jj Perez

Jj Perez Torre Deroche

Torre Deroche John Boik

John Boik Kyra Sundance

Kyra Sundance Jo M Martins

Jo M Martins Joanna Saltz

Joanna Saltz Joel Richard Paul

Joel Richard Paul Jim St Germain

Jim St Germain S A Evergreen

S A Evergreen John D Currid

John D Currid Molly Caro May

Molly Caro May Jim West

Jim West Matt Ridley

Matt Ridley

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Derrick HughesEmbark on an Epic Historical Odyssey: Lives Of Julius Caesar Nero Marcus...

Derrick HughesEmbark on an Epic Historical Odyssey: Lives Of Julius Caesar Nero Marcus... Matt ReedFollow ·5.6k

Matt ReedFollow ·5.6k Oscar WildeFollow ·6.2k

Oscar WildeFollow ·6.2k Gavin MitchellFollow ·7.5k

Gavin MitchellFollow ·7.5k Angelo WardFollow ·4.1k

Angelo WardFollow ·4.1k Ernest J. GainesFollow ·19.1k

Ernest J. GainesFollow ·19.1k Kirk HayesFollow ·3.3k

Kirk HayesFollow ·3.3k W. Somerset MaughamFollow ·12.2k

W. Somerset MaughamFollow ·12.2k Brett SimmonsFollow ·4.7k

Brett SimmonsFollow ·4.7k

Jesus Mitchell

Jesus MitchellDiscover the World of Satisfying Meals with Or...

In a world where culinary creations often...

Darius Cox

Darius CoxJourney into the Extraordinary Life of Kublai Khan: An...

Immerse Yourself in the Fascinating...

Gil Turner

Gil TurnerThe Fourth Industrial Revolution: The Precariat and the...

In his groundbreaking book, The Fourth...

Jonathan Franzen

Jonathan FranzenGenghis Khan: His Heirs and the Founding of Modern China

Genghis Khan, the...

Eugene Powell

Eugene PowellJourney Through the Golden Age of the Ottoman Empire with...

Delve into the Enchanting World of the...

5 out of 5

| Language | : | English |

| File size | : | 19811 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 397 pages |

| Lending | : | Enabled |