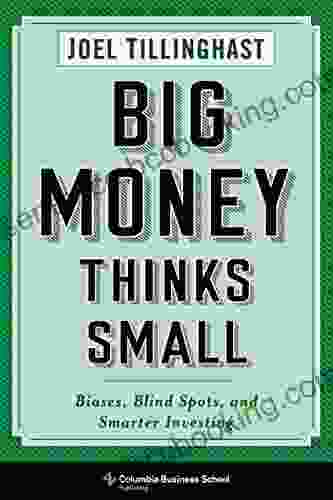

Biases, Blind Spots, and Smarter Investing: A Comprehensive Guide for Investors

Investing is a complex and challenging endeavor, and even the most experienced investors can fall prey to biases and blind spots that can lead to poor decision-making.

4.4 out of 5

| Language | : | English |

| File size | : | 888 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 314 pages |

| Lending | : | Enabled |

In this comprehensive guide, Columbia Business School professors and investment experts Daniel Kahneman, Olivier Sibony, and Cass R. Sunstein provide a deep dive into the cognitive biases and blind spots that can influence our investment decisions.

Chapter 1: The Nature of Biases and Blind Spots

The book begins by exploring the nature of biases and blind spots, and how they can impact our thinking and decision-making.

Kahneman, Sibony, and Sunstein explain that biases are systematic errors in judgment that arise from our cognitive shortcuts and mental heuristics.

Blind spots, on the other hand, are areas of ignorance or weakness in our knowledge or understanding.

The authors provide numerous examples of biases and blind spots that can affect investors, such as:

- Confirmation bias: The tendency to seek out information that confirms our existing beliefs.

- Hindsight bias: The tendency to believe that we could have predicted an event after it has already occurred.

- Overconfidence bias: The tendency to overestimate our own abilities and knowledge.

- Framing bias: The tendency to make different decisions depending on how information is presented.

Chapter 2: Biases in Investment Decisions

In Chapter 2, the authors explore how biases and blind spots can manifest themselves in specific investment decisions.

They discuss how biases can lead to:

- Overtrading: Buying and selling stocks too frequently.

- Chasing performance: Investing in funds or managers with a history of strong returns, even if those returns are not sustainable.

- Anchoring bias: Relying too heavily on initial information when making investment decisions.

- Herding behavior: Following the crowd and investing in popular stocks or funds.

Chapter 3: Blind Spots in Investment Analysis

Chapter 3 focuses on blind spots in investment analysis, and how they can lead to poor investment decisions.

The authors discuss how blind spots can arise from:

- Lack of knowledge: Not having a deep understanding of the companies or industries you are investing in.

- Incomplete information: Not having access to all the relevant information about a company or investment.

- Cognitive dissonance: Holding two or more contradictory beliefs about an investment.

- Emotional biases: Letting your emotions get in the way of making rational investment decisions.

Chapter 4: Overcoming Biases and Blind Spots

In the final chapter, the authors provide practical strategies for overcoming biases and blind spots in investment decisions.

They discuss the importance of:

- Self-awareness: Being aware of your own biases and blind spots.

- Seeking out diverse perspectives: Getting input from others with different viewpoints.

- Slowing down and thinking critically: Taking the time to consider all the relevant information before making investment decisions.

- Using decision-making tools: Employing tools such as checklists and decision matrices to help you make more rational decisions.

Biases, Blind Spots, and Smarter Investing is a comprehensive and thought-provoking guide for investors of all levels.

The book provides a deep understanding of the cognitive biases and blind spots that can impact investment decisions, and offers practical strategies for overcoming them.

4.4 out of 5

| Language | : | English |

| File size | : | 888 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 314 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Joseph Iannuzzi

Joseph Iannuzzi John Diary

John Diary John D Batista

John D Batista John Madieu

John Madieu Katherine Battersby

Katherine Battersby Robert Macklin

Robert Macklin Johan Huizinga

Johan Huizinga Gary Westphalen

Gary Westphalen Joachim Zentes

Joachim Zentes John Hughes

John Hughes John Gookin

John Gookin John Gibbon

John Gibbon Patti Mollica

Patti Mollica John L Field

John L Field Karolyn Smardz Frost

Karolyn Smardz Frost Jody Nyasha Warner

Jody Nyasha Warner Notesbo Funny

Notesbo Funny Joanne Simon Walters

Joanne Simon Walters Luke Sullivan

Luke Sullivan Joe Clement

Joe Clement

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Jaime MitchellThe Real Life Stories of Thai Novice Monks: A Journey of Spirituality and...

Jaime MitchellThe Real Life Stories of Thai Novice Monks: A Journey of Spirituality and... Sam CarterFollow ·7.4k

Sam CarterFollow ·7.4k Michael SimmonsFollow ·13k

Michael SimmonsFollow ·13k Paul ReedFollow ·3k

Paul ReedFollow ·3k Richard WrightFollow ·17.4k

Richard WrightFollow ·17.4k Franklin BellFollow ·7.9k

Franklin BellFollow ·7.9k Aubrey BlairFollow ·8.6k

Aubrey BlairFollow ·8.6k Aron CoxFollow ·17.6k

Aron CoxFollow ·17.6k Chase MorrisFollow ·10.3k

Chase MorrisFollow ·10.3k

Jesus Mitchell

Jesus MitchellDiscover the World of Satisfying Meals with Or...

In a world where culinary creations often...

Darius Cox

Darius CoxJourney into the Extraordinary Life of Kublai Khan: An...

Immerse Yourself in the Fascinating...

Gil Turner

Gil TurnerThe Fourth Industrial Revolution: The Precariat and the...

In his groundbreaking book, The Fourth...

Jonathan Franzen

Jonathan FranzenGenghis Khan: His Heirs and the Founding of Modern China

Genghis Khan, the...

Eugene Powell

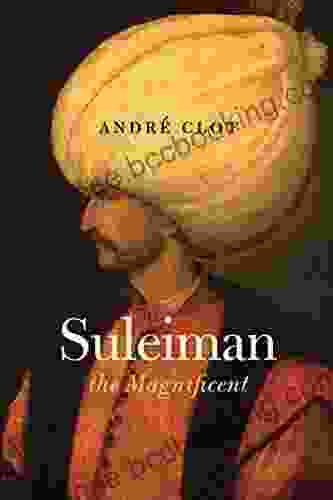

Eugene PowellJourney Through the Golden Age of the Ottoman Empire with...

Delve into the Enchanting World of the...

4.4 out of 5

| Language | : | English |

| File size | : | 888 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 314 pages |

| Lending | : | Enabled |